The three main political parties offer voters widely different choices on tax.

Taxes

Taxes

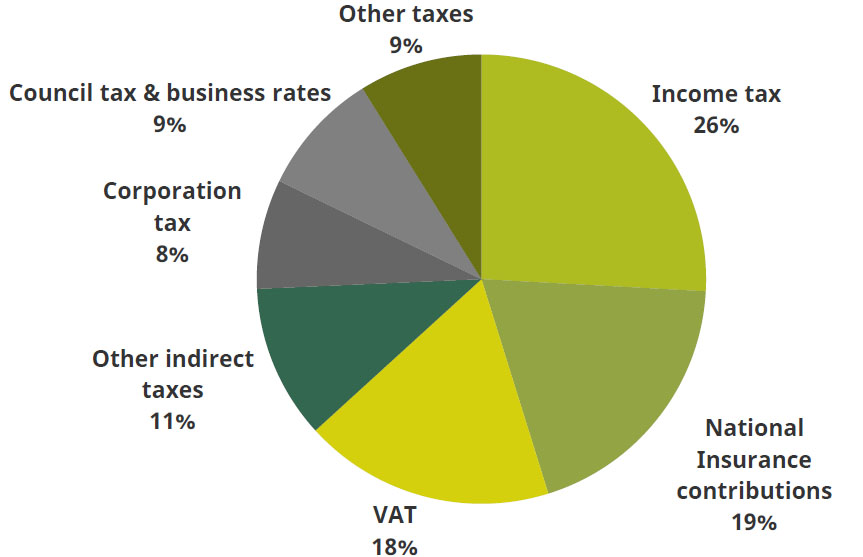

Tax revenues are forecast to be £760 billion in 2019–20, or 34½% of national income – the highest sustained share since the 1940s, though not high by international standards. Almost two-thirds of tax revenue comes from just three taxes – income tax, National Insurance contributions and VAT (see chart).

Given pressures from demographic change and the various spending promises being made by the main parties, taxes might need to rise further. But the next government will also need to respond to threats to existing revenue streams, such as the shift from employment to self-employment (which is taxed less) and declining revenue from petrol and diesel taxes. A reliance on asking big companies and ‘the rich’ to pay more has it its limits and would be far from risk-free.

In the run-up to the 2019 general election we will be publishing analysis on what has happened to taxes to date and what the parties are proposing.

The composition of UK tax revenue, 2019–20

Useful resources

Election 2019 analysis

Tax in the manifestos

The distributional impact of personal tax and benefit reforms, 2010 to 2019

The tax and benefit system has undergone significant reform since 2010, with large cuts to working-age benefits, a rise in the main rate of VAT, increases in the rate of the state pension, and reductions in direct tax, including a big rise in the income tax personal allowance. In this briefing note we investigate the impact that these reforms have had on household incomes.

Conservatives’ proposed NICs cut would cost at least £2.4 billion a year and mostly benefit middle- and higher-income households

Boris Johnson has announced that he would raise the threshold for paying National Insurance contributions (NICs) in the first Budget of a Conservative government. This observation examines the effect of raising the NICs threshold to £9,500, assuming it is implemented in April 2020.

Labour’s proposed income tax rises for high-income individuals

The Labour Party plans to increase income tax for individuals with annual taxable incomes over £80,000. Under the current system, income tax is payable on incomes above the personal allowance of £12,500 a year.

Cancelling further cut to corporation tax rate leaves revenue the same as before the 2008 crisis

Boris Johnson has today announced that a Conservative government would not go ahead with the planned reduction in the rate of corporation tax from 19% to 17% next April.

Tax and spending since the crisis: is austerity over?

In the aftermath of the global financial crisis and associated recession, government borrowing soared to more than 10% of national income. Borrowing has since been reduced through a combination of net tax rises, cuts to the generosity of the working-age social security system and cuts to public service spending.

How high are our taxes, and where does the money come from?

Taxation is set to be a central policy battleground in this election, as in so many others. This Briefing Note provides some essential factual background to the parties’ claims and policies, placing the UK’s current tax burden in historical and international context and discussing where – and who – the revenue comes from.

Background analysis

Briefing notes

How do other countries raise more in tax than the UK?

The effect of taxes and benefits on UK inequality

Tax and spending since the crisis: is austerity over?

How high are our taxes, and where does the money come from?

Observations

Is our tax system fair? It depends…

Cancelling further cut to corporation tax rate leaves revenue the same as before the 2008 crisis

Green Budget analysis

Options for cutting direct personal taxes and supporting low earners

Tax, legal form and the gig economy

Reports

Better budgets: making tax policy better

Book

Reforming the Tax System for the 21st Century: The Mirrlees Review

Presentations

Tax reliefs: the good, the bad and the money

Social media

Taxes account for almost 35% of national income - their highest sustained level since the 1940s. But UK taxes are not high by international standards.

— IFS (@TheIFS) November 27, 2019

Visit our #GE2019 website, funded by @NuffieldFound, for the facts on all the key election issues: https://t.co/06eGPJkLmS pic.twitter.com/PB3BmhinJU

All 3 main parties have now announced plans for corporation tax rates.

— IFS (@TheIFS) November 21, 2019

In the short term these plans could raise £20bn (Lab) / £8bn (LD) / £6bn (Con) a year relative to pre-election plans to cut the rate to 17%.

In the longer term, lower investment would reduce these figures. pic.twitter.com/7UPemMkxxV

Raising the threshold for paying National Insurance contributions would cost £2.4 billion a year if only employee and self-employed NIC thresholds were raised.

— IFS (@TheIFS) November 21, 2019

It would cost £3.9 billion if the employer NICs threshold was raised in tandem.

Read more: https://t.co/RL5MJCp0MB pic.twitter.com/riPz6SS9Em

Labour plans to introduce a 45% income #tax rate on annual incomes over £80,000 and a 50% rate on incomes over £125,000 from 2020–21.

— IFS (@TheIFS) November 20, 2019

This would raise income tax for 1.6 million people.

⁰New #GE2019 analysis, funded by @nuffieldfound: https://t.co/fiubXQRx12 pic.twitter.com/AMMVGKyAaP

The main parties all say they want to reduce the UK's greenhouse gas emissions to net zero by 2050 at the latest – but the UK is still nowhere near meeting the target.

— IFS (@TheIFS) November 14, 2019

Any taxes targeting the carbon people produce need careful consideration to avoid making some worse off. pic.twitter.com/XJrrZmtmZ8

Taxes account for almost 35% of national income - their highest sustained level since the 1940s. But UK taxes are not high by international standards.

— IFS (@TheIFS) November 13, 2019

Visit our #GE2019 website, funded by @NuffieldFound, for the facts on all the key election issues: https://t.co/06eGPJkLmS pic.twitter.com/B9AD91c0Am