Benefits

Benefits

Social security spending (spending on benefits, tax credits and state pensions) is the biggest single component of government spending. The design and size of the system affects the incomes and incentives of millions of families.

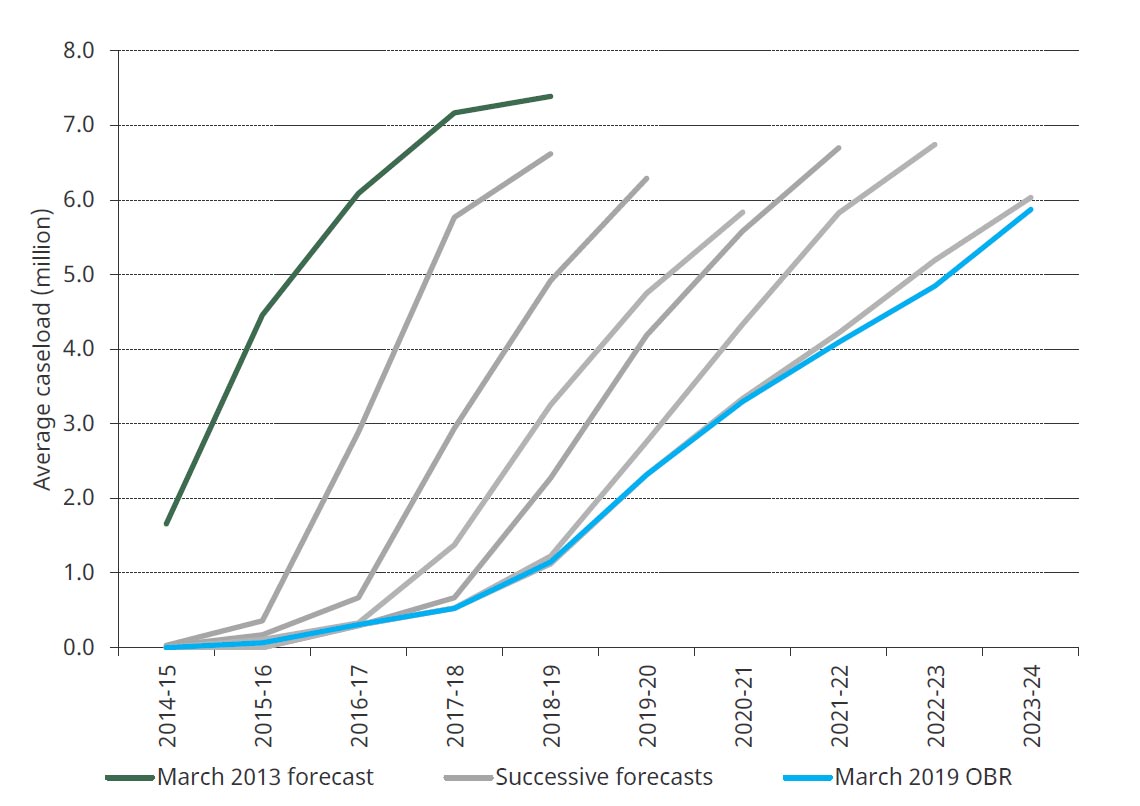

The government is currently in the process of replacing six existing means-tested benefits with a single integrated payment - Universal Credit (UC). This represents the most radical shake-up to the working-age benefit system in decades, directly affecting around 7 million households who will eventually be receiving it. But currently only about 2.5 million households are on UC (see figure) - and completing that rollout with minimal disruption represents a big challenge for the next government. This reform comes against the backdrop of significant cuts to working-age benefits implemented since 2010, while pensioners have been mostly protected and have benefited from the 'triple lock' on the state pension.

The next government will face important choices about how much to spend on benefits and the state pension, and where that money should go. In the run-up to the 2019 general election we will be publishing analysis of benefit and pension changes that parties are proposing.

Successive forecasts of the rollout of Universal Credit

Useful resources

Election 2019 analysis

The distributional impact of personal tax and benefit reforms, 2010 to 2019

The tax and benefit system has undergone significant reform since 2010, with large cuts to working-age benefits, a rise in the main rate of VAT, increases in the rate of the state pension, and reductions in direct tax, including a big rise in the income tax personal allowance. In this briefing note we investigate the impact that these reforms have had on household incomes.

Benefit changes set to take effect during the next parliament

While the benefit system has undergone substantial reform over the past 10 years, there remain significant changes due to take place over the next parliament.

A decade of cross-party increases in the state pension age

This briefing note describes the state pension age increases that have been legislated by various governments in recent decades, and discusses how they relate to improvements in life expectancies and how spending on state pensions is projected to evolve as a result.

Background analysis

Briefing note

Universal credit and its impact on household incomes: the long and the short of it

Benefit changes set to take effect during the next parliament

Tax and spending since the crisis: is austerity over?

A decade of cross-party increases in the state pension age

Social media

#IFSSatStat Benefits policy will present big challenges for the next government. #UniversalCredit will change entitlements for about 80% of all working-age households entitled to means-tested benefits - even more among households in work.

— IFS (@TheIFS) November 23, 2019

Read more: https://t.co/K3kcS3Dvnt pic.twitter.com/iyk3JSxNov

Benefits policy will present big challenges for the next government.

— IFS (@TheIFS) November 18, 2019

Today, about 2½ million families are on #universalcredit, but on existing plans that number will reach 7 million by 2024–25.

A #GE2019 briefing, funded by @NuffieldFound: https://t.co/K3kcS3Dvnt pic.twitter.com/OEopwFqxik

Despite substantial cuts to the generosity of the social security system since 2010, spending on working age benefits is no lower as a share of the economy than it was pre-crisis. pic.twitter.com/0V5ya2EDo5

— IFS (@TheIFS) November 17, 2019